straight life annuity death benefit

Members may elect one of four options for the ATRS retirement annuity. C The member may elect not to name a beneficiary and have his or her pre-retirement death benefit paid as a monthly annuity calculated as though the member had retired as of the date of his or her death and elected a Straight Life annuity to a minor child or children until the minor child or children attains age 21 or sooner marries or becomes emancipated.

Annuities And Individual Retirement Accounts Ppt Video Online Download

Depending on the contract other events such as terminal illness or critical illness can.

. It can be anyone from your spouse children to your parents. In other words if an annuity owner dies before payouts begin the beneficiary will receive the current value of the contract. When would a 20-pay whole life policy endow.

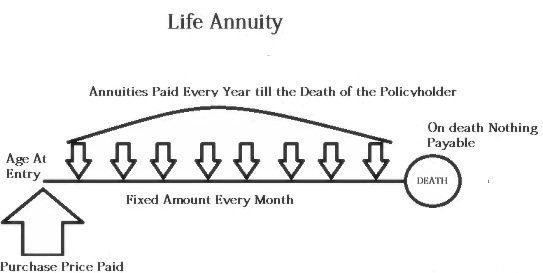

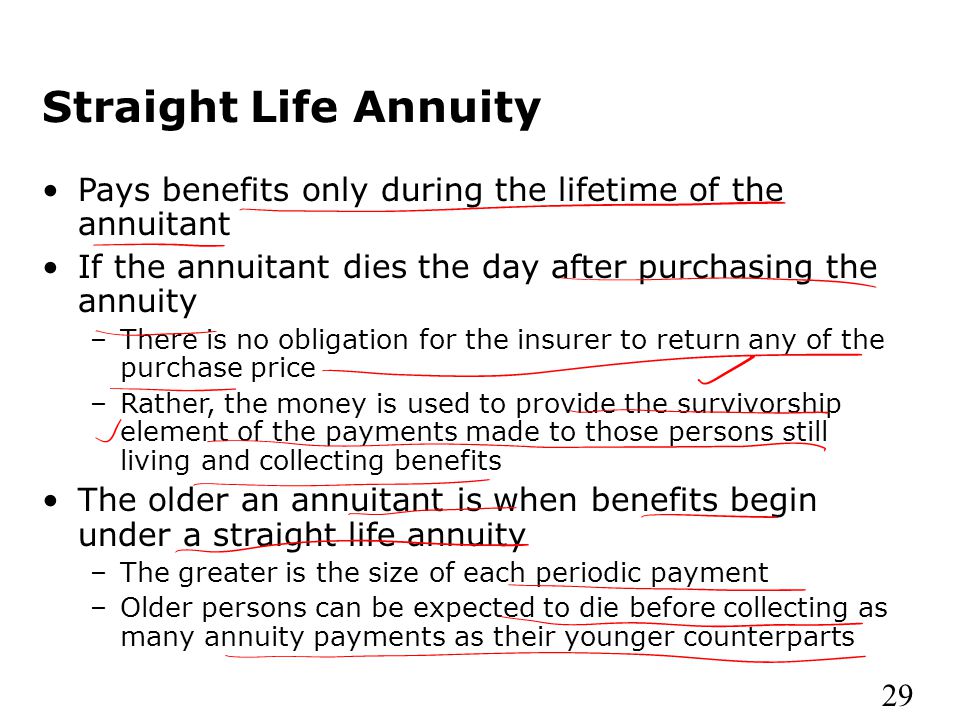

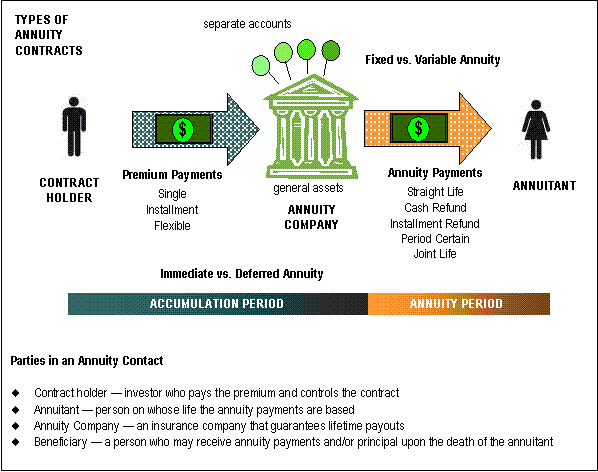

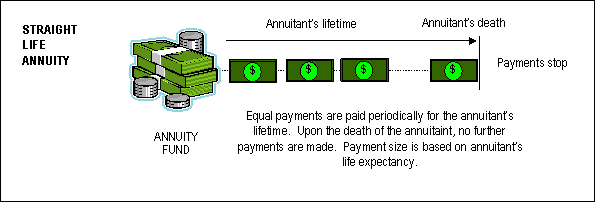

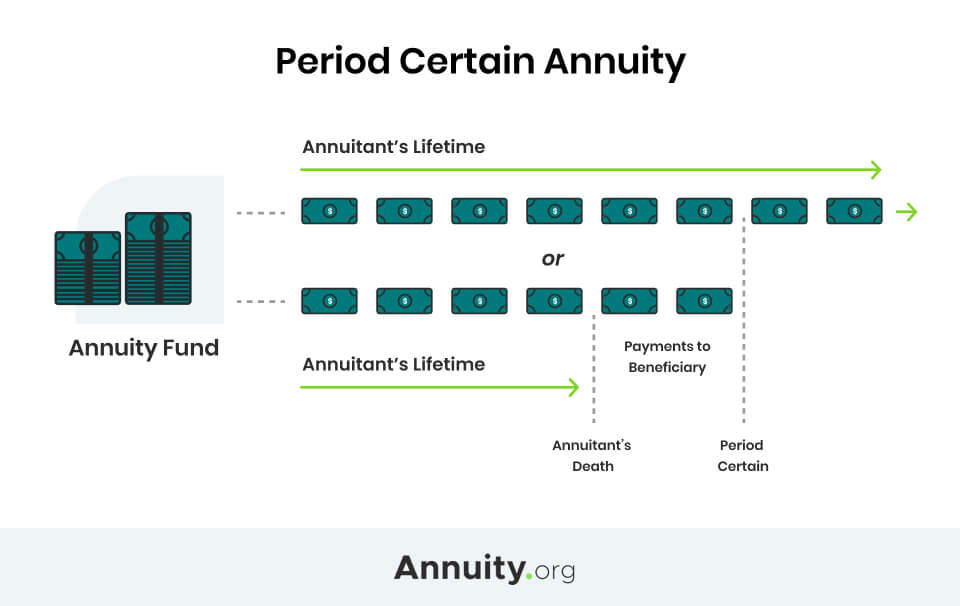

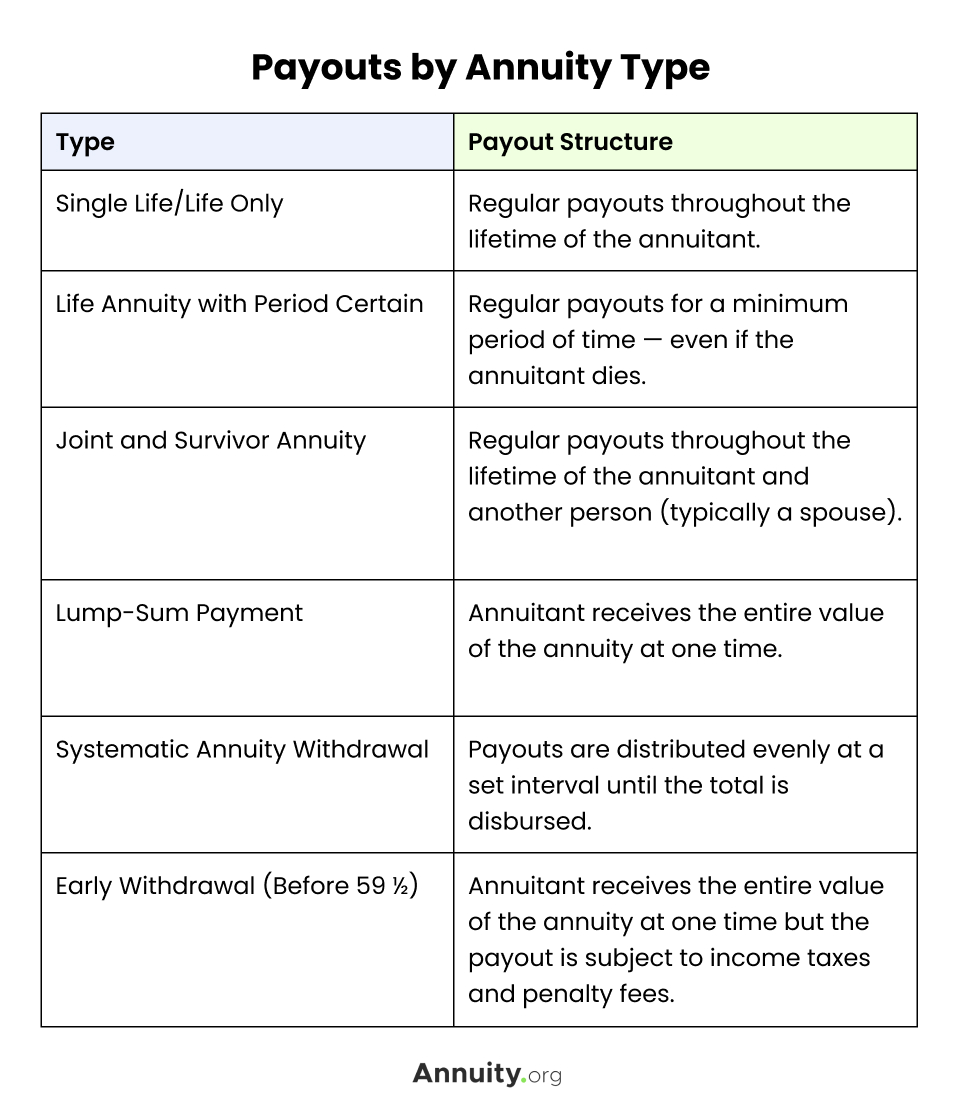

The beneficiary would collect the death benefit if both annuitants die before the end of the period. A straight life annuity is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit. A death benefit usually accompanies this type of annuity.

You can also include a period certain and name a beneficiary. Straight Life Income The life insurance company will make periodic payments that are guaranteed to last for the rest of a beneficiarys life no matter how long that person lives. Accidental death benefit riders provide an additional sum to a life insurance payout in case an unexpected passing leaves your family members strapped for finances.

A 5-year 10-year or 15-year certain-and-continuous annuity that provides you with fixed monthly benefit payments for your lifetime. Why is an equity index annuity consider to be a fixed annuity 1. Survivor annuity to the spouse upon the death of the retiree.

It is not tied to an index like sp 500 3. Term insurance provides financial security and protection for the family members of the life insured in case of an unfortunate event. This choice reduces the amount of each payment you would have received with a straight-life annuity or a life annuity with period certain.

Income-focused annuity offers 25 Benefits Account Value Bonus as well as guaranteed lifetime income benefit and enhanced death benefit at no fee. Death benefit Usually seen in a term-life or other life insurance policy it refers to the amount paid out by the insurer to the beneficiary if you or the person insured dies when the policy is still active. For more information see Review of Annuity Options.

Furthermore it provides flexibility so that they can pay a higher premium to get additional coverage in the. EstateShield 10 Fixed Index Annuity. See Your PBGC Benefit Options for more information.

After 20 payments 3. In 20 years 4. This is one of the more confusing life insurance settlement options because there are four types of options to choose from.

The meaning of ANNUITY is a sum of money payable yearly or at other regular intervals. Some plans anticipate the possibility that the retiree will outlive the spouse by offering a pop-up feature which increases the annuity payment upon the death of the spouse. Final average salary refers to the average of the 5 highest fiscal year salaries out of the last 15 fiscal years of contributing.

It has a fixed rate of return 2. Ad Learn More about How Annuities Work from Fidelity. Beneficiary The person that youve nominated to receive your insurance pay-out in the event of your death.

The Survivor Benefit Plan SBP ensures a military retirees dependents receive a continuous lifetime annuity. If an active member becomes disabled while working for a participating employer and has five 5 or more years of actual and reciprocal service with ATRS the member may apply. The amount of interest that has accumulated in the policys cash value D.

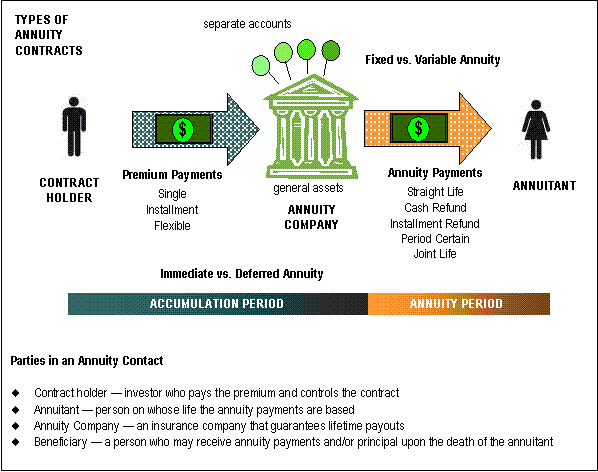

Subsidized Early Retirement Benefit - A benefit amount that is not reduced or is reduced less than the full actuarial amount for retirement before normal retirement age. A death benefit is a payout to the beneficiary of a life insurance policy annuity or pension when the insured or annuitant dies. This long-term amount can be paid on a monthly quarterly or annual basis.

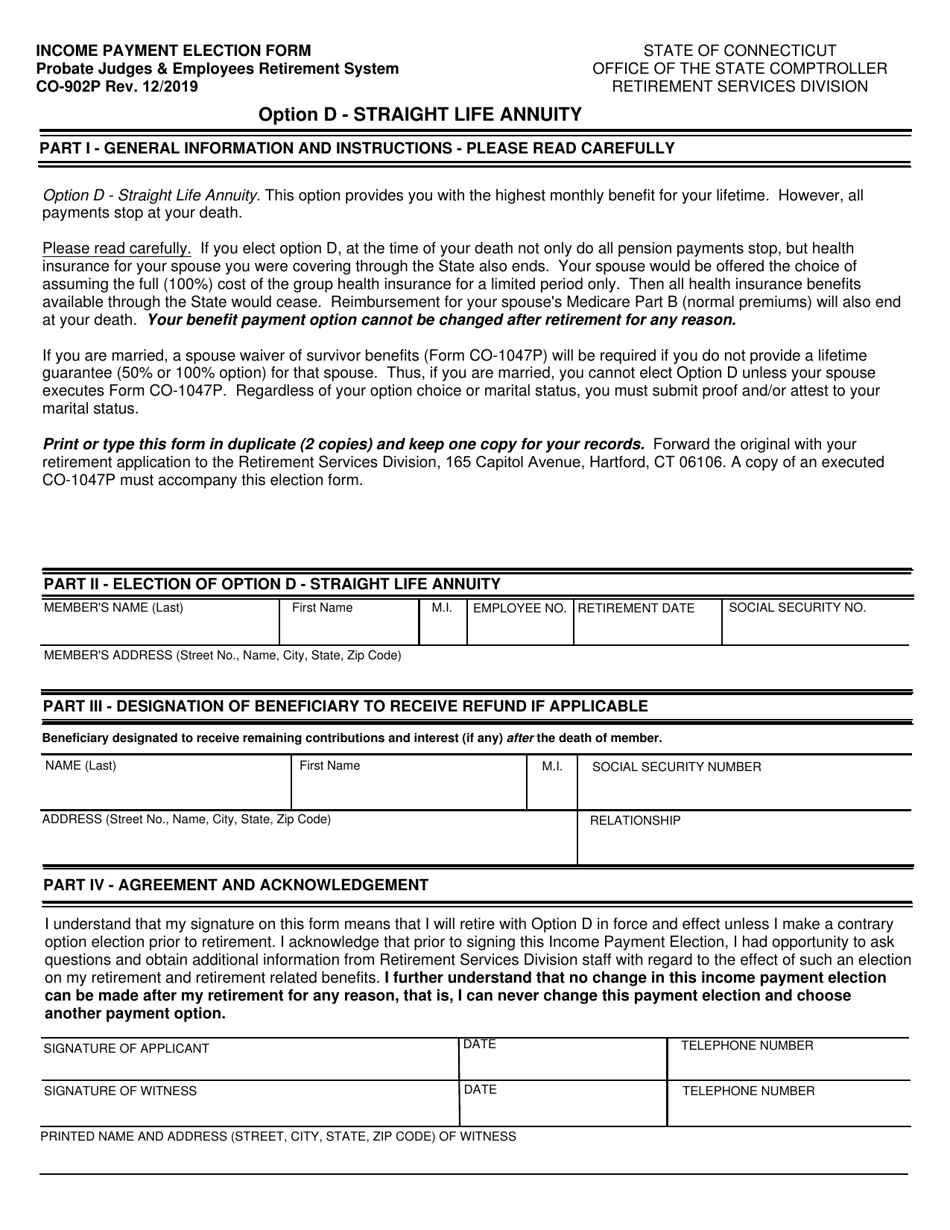

Life Income with Period Certain One of the big disadvantages of a straight life payout is that if a beneficiary. No survivor benefit will be paid after your death. Ad Learn More about How Annuities Work from Fidelity.

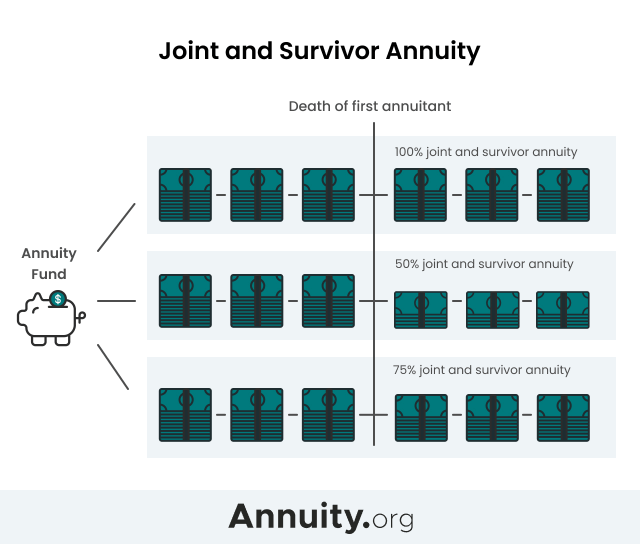

Cash lump sums are taxed according to the retirement lump sum tax table as though they had. Over their two lifespans the benefit is designed to be equivalent to the straight-life annuity. BUREAU OF LABOR STATISTICS.

In no event shall. It has a guaranteed minimum interest rate 4. Since you need a license to do so which comes with the California Life and Health Insurance Agent exam therefore you need a lot of practice for making it through the exam itself.

A straight life annuity is. The primary benefit of owning a joint and survivor annuity is the guarantee that payments will last for the rest of the annuity owners life and the life of another person. At the insureds age 65 2.

The annuity income will be taxed in the hands of the recipient per the prevailing income tax tables. See chart 2 To offset the cost of the survivor benefit the straight-life annuity benefit is reduced. Life insurance or life assurance especially in the Commonwealth of Nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person often the policy holder.

When the insured. It has a guaranteed minimum interest rate. If you elect this type of life annuity and die before the end of the 5- 10- or 15-year time period you selected.

This option allows the annuitant to receive the entire value. The point in time when the policys. Life insurance policies are generally purchased to provide coverage for an unforeseen unfortunate event like the insured persons death.

The reduction is based on the age of the retiree and spouse. Annual Retirement Benefit under Straight Life. Straight-Life Annuity - An annuity that pays benefits typically monthly for one persons life with no survivor benefits after that person dies.

A straight-life annuity that provides you with fixed monthly benefit payments for your lifetime. The gap between the total death benefit and the policys cash value B. Because the original annuity was reduced to offset the cost of a survivor benefit the ultimate benefit received by the retiree will be less than equivalent to the straight-life annuity.

The gap between when a claim is filed and when the death benefit is received C. Because the second person is an annuitant as opposed to a beneficiary the timeframe for the payment will most likely be longer and therefore the tax liabilities will be spread over a longer period of time. This California life and health insurance exam quiz is useful for those individuals who are looking towards producing or selling life andor health insurance in the state of California.

It has a modest investment potential. How to use annuity in a sentence. A regular retirement benefit under the Straight Life annuity option is an amount equal to 2 of a members final average salary multiplied by the members years of service credit paid in equal monthly installments.

What is a corridor in relation to a Universal Life insurance policy. A 55-year-old male beneficiary chooses the life income option and receives 6250 for life based on his age and gender. Beyond these two required.

Find answers to common SBP questions on our FAQ page. To understand how the straight life income option works imagine a policy with a 100000 death benefit. The beneficiaries who will receive a share of the death benefit can choose to receive their benefit either as a cash lump sum or as an annuity or as a combination of the two.

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Annuity Payout Options Immediate Vs Deferred Annuities

What Is A Straight Life Annuity Everything You Need To Know

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Period Certain Annuity What It Is Benefits And Drawbacks

Form Co 902p Download Fillable Pdf Or Fill Online Income Payment Election Form Option D Straight Life Annuity Connecticut Templateroller

Is A Straight Life Policy Right For Me Paradigmlife Net Blog

Joint And Survivor Annuity The Benefits And Disadvantages

Annuity Payout Options Immediate Vs Deferred Annuities

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Straight Life Annuity Providing Peace Of Mind In Your Retirement

What Is A Straight Life Annuity Retirement Watch

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

What Is A Straight Life Annuity Everything You Need To Know

What Is A Straight Life Annuity Everything You Need To Know

Straight Life Annuity For Retirement Is It Right For You Paradigm Life